Disclosure regarding our editorial content standards.

A loan shark is an illegal lender that charges high interest rates and may use the threat of violence to collect debt.

When people are strapped for cash, they may resort to borrowing from unlicensed lenders. Although these lenders may initially seem friendly, they can take advantage of borrowers and put them into debt cycles that are extremely hard to get out of.

These lenders are known as loan sharks, and it is important that you know how to spot them so that you can avoid falling victim to their predatory lending. In this article, we’ll break down how to identify a loan shark and how to protect yourself.

What is a loan shark?

A loan shark is a lender who operates illegally and offers extremely high interest rates. Oftentimes, loan sharks are part of organized crime groups who will use aggressive tactics—such as threats of violence or blackmail—to collect debts.

How does a loan shark work?

A loan shark will often target people who live paycheck to paycheck or are in desperate financial need. They may even seek out low-income families and small business owners who they suspect may be struggling. In response, loan sharks will provide a large, short-term loan with extremely high interest rates (sometimes up to 20 percent per week) that are difficult to pay off. If a borrower fails to provide payment, loan sharks will add extra costs or even resort to violence to collect debt.

What happens if you don’t pay?

As mentioned above, loan sharks use aggressive tactics to collect debts such as:

- Blackmail

- Harassment

- Defamation

- Stealing

- Stalking

- Violence

Are loan sharks illegal?

Loan sharks are unlicensed lenders and operate illegally. It is important to note that it is usually not illegal to borrow money from a loan shark, so you will not face charges if you report one. However, we recommend checking with the laws of your country or state to be sure.

Oftentimes, illegal loan sharks will threaten to sue borrowers as a way to collect debt. However, since they are not operating within the law, they are unable to use the legal system to enforce payment.

How to identify a loan shark

Loan sharks may start off friendly, portraying themselves as a caring person offering to help you financially. Here are a few warning signs that you may be dealing with a loan shark:

- You’re presented with a cash loan. Loan sharks often provide cash loans to avoid a paper trail.

- There’s no paperwork to accompany the loan. Unlike legal loans which require paperwork outlining the terms, loan sharks will provide little to no information about the loan.

- The loan has an extremely high interest rate. Loan sharks will charge high interest rates—usually up to 20 percent per week or 400 percent per year.

- No background or credit checks are required. While licensed lenders require personal information and usually perform a credit check, loan sharks do not require any documentation.

- They ask for your possessions as collateral. Loan sharks may request important items like a passport or driver’s license to be used as “security” for the loan.

- A recent acquaintance offers you a loan. A loan shark can pose as a friend of a friend and appear trustworthy, so it is important to never accept a loan from someone you recently met.

Real-world example

An example of a loan shark would be a lender who offers a $5,000 loan with interest and therefore insists that you pay $10,000 by the end of the month. If the borrower is unable to make payment, the loan shark may resort to threats or violence. The loan shark may also force the borrower to take out more loans to repay the initial debt, which creates a vicious cycle that is tricky to get out of.

While many regard loan sharks as a thing of the past, it is important to remember that these criminals are still out there and are finding new ways to target victims. According to The Guardian, loan sharks in the U.K. are using platforms like WhatsApp and Facebook and dating websites to prey on victims.

Loan sharks vs. payday lenders: What’s the difference?

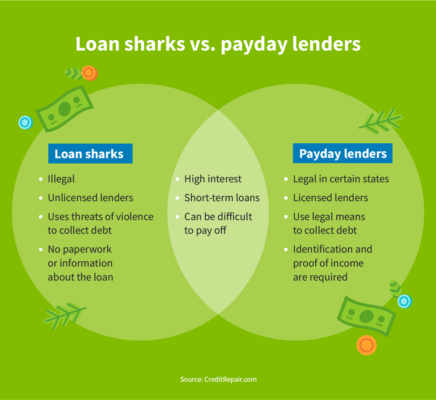

Loans sharks are often mistaken for payday lenders and vice versa. So, what’s actually the difference between these two lenders?

Like loan sharks, payday lenders provide short-term loans with higher-than-average interest rates, so it can be difficult to tell them apart. However, payday lenders will usually require personal information, like identification and proof of income, before granting your loan. Unlike loan sharks, they don’t resort to violence in response to unpaid debt and instead will adhere to debt collection laws.

Understanding their difference can also be tricky, since payday loans have both pros and cons, and the legality of payday lenders greatly varies by state. In states where payday lenders are legal, they are typically heavily regulated and interest is capped at around 24 to 48 percent per year.

Although payday lenders may be legal in some states, their high interest rates still make it difficult to pay off debt, so it is best to seek out alternative options.

Alternative ways to borrow money

Many people seek out loan sharks because they may have bad credit and are unable to qualify for other types of loans. However, to avoid loans with high interest rates, you may want to look into other means of borrowing money like:

- Payday alternative loans (PALs). Some credit unions offer these short-term loans of under $2,000 that typically have relatively low interest rates. The requirements to qualify are generally less strict than other loan options.

- Installment loans. These loans break up payments over a set amount of time. Installment loans can include mortgages, auto loans, student loans and personal loans.

- Secured loans. These loans require financial assets for collateral, such as a house or car. However, if you default on the loan, the lender can claim the asset as repayment.

- Trusted friends or family members. Although borrowing from friends and family is typically not recommended, it may be the best course of action for your situation. The best way to go about this is to create a formal loan contract and payment schedule.

These alternative options have lower interest rates and give you a better chance of paying off debt.

How to deal with a loan shark and protect yourself in the future

If you are dealing with a loan shark, there are a few things you can do.

- Maintain a record of threats.

- Report the loan shark to your local authorities.

- Visit your local Attorney General’s office website for information about how your state deals with loan sharks.

The best way to protect yourself from loan sharks is to not seek out short-term loans in the first place. A good solution is to find places to save money and create a savings account to use only in case of emergencies. If you do need to take out a loan, always verify your lender with your state’s bank commissioner to make sure they are authorized and operating legally.

Another option is to improve your credit so that you qualify for lower-interest loans. If you need help improving your credit, CreditRepair.com has credit repair advisors who can work with you to create a game plan for reaching your financial goals.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263